F1.4 Determine the growth of simple and compound interest at various rates using digital tools, and explain the impact interest has on long-term financial planning.

Activity 1: Determine the Increasing Value of Simple and Compound Interest

Offer the following situation to students:

Laurent wants to borrow $1000 for a period of 10 years and is given two options.

|

Financial Institution |

Duration |

Interests |

|

DEF |

5 years |

3% simple interest |

|

MNO |

5 years |

2% compound interest |

Have students determine the increasing value of the two options using a digital tool.

Ask students the following questions:

- What is the difference between borrowing with simple interest versus compound interest?

- Which option is more cost effective for Laurent? How do you know?

Activity 2: Explain the Impact of Interest in Long-Term Financial Planning

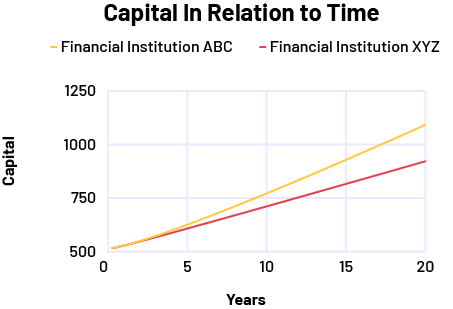

Show students the graph below.

Source: translated from En avant, les maths!, 8e année, CM, Littératie financière, p. 5

Ask students the following questions:

- Which of the two institutions do you think offers a simple interest rate? a compound interest rate? Justify your reasoning.

- Which of the following options earns the most interest given that you would like to invest $500 for a 10-year period? Explain your reasoning.